Why are we here?

At Amigo Loans, we just want to give people the chance to borrow even if they don’t have the perfect credit score.

So, if you’ve been told no in the past, our mission is to make borrowing possible and affordable when you need a chance to improve your life.

If someone's got your back, Amigo can back you too

An old fashioned idea brought to present day life. Sadly, we can't say we were the first - guarantor lending has been around for decades. We’re here to keep the spirit of guarantor lending alive by choosing to trust a borrower, even if they don't have the best credit score, with the help of a guarantor.

So, in a nutshell, if you can comfortably afford the monthly repayments and you have someone that's got your back, then we can back you too.

This isn't just a business, it's a cause

What we are doing here is important because it makes borrowing possible for millions of ordinary people who are being excluded by banks. Without us our customers would only have extortionate payday loans to turn to.

Who are those people?

Amigo customers come in loads of different shapes and sizes. Young people, people who have been out of the UK for sometime and micro business entrepreneurs - all of which can all be viewed by banks as being risky when it comes to lending. What brings all of our customers together though it that they are trusted by their friends and families.

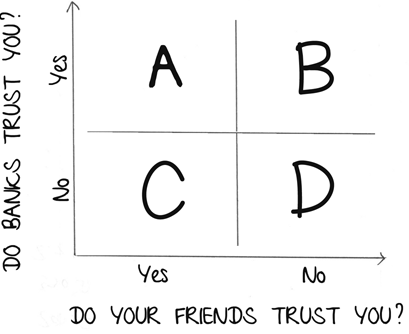

We believe everyone falls into one of these 4 boxes:

If you’re in box A:

you can borrow from a bank and you will repay. You don't need Amigo, you're likely to think we're expensive.

If you’re in box B:

you can borrow from a bank, but we don’t think you should be able to. Box B is the reason the credit crunch happened.

If you’re in box C:

the bank’s computer score has got you wrong. We estimate around two million people in the UK fit in box C, including many of our customers.

If you’re in box D:

you can't borrow from a bank or from us, in fact you shouldn't borrow from anyone right now. You might want to speak to Stepchange - your friends are telling you something, they know you best and borrowing is almost definitely not a good idea for you.

Who would be a guarantor?

I know what you're thinking; why not just borrow directly from your friend? Lots of people do. We're not trying to change that, but there’s a gap. As you’d expect, not everybody has a large amount of money they can lend. However, we’ve found that what is more important to guarantors is they’re enabling the borrower to build or rebuild their credit record, meaning they’ll be able to access more financial products in the future. Our own research tells us 67% of the UK would turn to family or friends if they were turned down for credit by the banks, and while many won’t have the money to lend, they still want to help. We’re offering a way to make it happen.

Why don’t guarantors get a bank loan in their own name for the borrower?

Surely a guarantor should be able to get a loan at a better rate? Some people do that too, but borrowing money yourself is very different to guaranteeing a loan. You have to manage the account yourself; make payments every month out of your own account; collect each payment from the borrower; the account is recorded on your credit file; applications, the loan balance and any late payments can affect your credit score. Most importantly, on an Amigo loan the borrower actually gets the chance to rebuild their credit rating. As payments are made on time, Amigo write back to all three UK credit reference agencies (Experian, Equifax and TransUnion) meaning that borrowers can eventually borrow on their own without help.

Amigo is expensive though right?

Actually no, not in context. It depends on what you compare us to and how you use the money. We believe we're one of the best options for people who can't get a loan from their bank. We're proud to set ourselves apart from payday loans with an apr up to 25 times smaller.